Journal Entry for Prepaid Insurance

Last Updated :

28 Aug, 2023

Prepaid Insurance is the amount of insurance premium that the company pays in one financial year, and avails its benefit in some other financial year, generally in the upcoming financial year. Prepaid Insurance journal entry is passed to record the amount paid as advance for the insurance. Prepaid insurance is treated as the asset of the firm and is recorded under the Asset side of the balance sheet. Insurance premium is generally paid by the company on behalf of its employees.

Prepaid Insurance Journal Entry

Journal Entry:

Example 1:

The Installment of insurance premium amounting to ₹5,000 was paid in advance.

Solution:

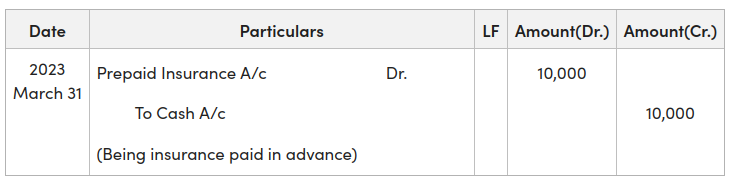

Example 2:

XYZ Company needs to pay the installment of insurance premium of ₹10,000 in the month of March every year. In March 2023, the company paid the insurance premium for the next year too, in cash. Record the necessary journal entry for the year ending 2022-23.

Solution:

Please Login to comment...