Trading Procedure on a Stock Exchange

Last Updated :

06 Apr, 2023

A market that serves as a link between the savers and borrowers by transferring the capital or money from those who have a surplus amount of money to those who are in need of money or investment is known as Financial Market. Simply put, Financial Market is a market that creates and exchanges financial assets. In general, the investors are known as the surplus units and business enterprises are known as the deficit units. Hence, a financial market acts as a link between surplus units and deficit units, and brings the borrowers and lenders together.

Stock Exchange

The Securities Contract and Regulation Act defines a stock exchange as, “An organisation or body of individuals, whether incorporated or not established for the purpose of assisting, regulating, and controlling of business in buying, selling, and dealing in securities.”

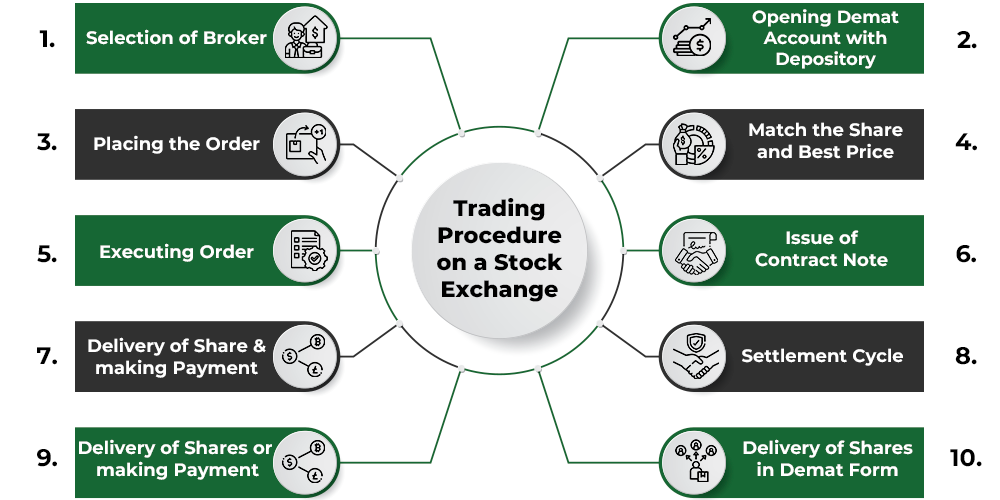

Trading Procedure on a Stock Exchange

Before the companies start selling the securities through the stock exchange, they have to first get their securities listed on the stock exchange. The name of the company is included in listed securities only when the authorities of the stock exchange are satisfied with the financial soundness and various other aspects of the company.

Earlier, the buying and selling of securities were done on the trading floor of the stock exchange. However, in present times, it is done through computers and consists of the following steps:

1. Selection of Broker

One can buy and sell securities only through the brokers registered under SEBI and who are members of the stock exchange. A broker can be a partnership firm, an individual, or a corporate body. Hence, the first step of the trading procedure is the selection of a broker who will buy/sell securities on the behalf of a speculator or investor. Before placing an order to the registered broker, the investor has to provide some information, including PAN Number, Date of Birth and Address, Educational Qualification and Occupation, Residential Status (Indian/NRI), Bank Account Details, Depository A/c details, Name of any other brokers with whom they have registered, and Client code number in the client registration form. After getting information regarding all the said things, the broker opens a trading account in the name of the investor.

2. Opening Demat Account with Depository

An account that must be opened with the Depository Participant (including stock brokers or banks) by an Indian citizen for trading in the listed securities in electronic form is known as Demat (Dematerialised) Account or Beneficial Owner (BO) Account.

The second step of the trading procedure is the opening of a Demat Account. The Depository holds the securities in electronic form. A Depository is an organisation or institution, which holds securities like bonds, shares, debentures, etc. At present there are two Depositories; namely, NSDL (National Securities Depository Ltd.) and CDSL (Central Depository Securities Ltd.). The Depository and the investor do not have direct contact with each other and interact with each other through Depository Participants only. The Depository Participant will have to maintain the securities account balances of the investor and intimate investor from time to time about the status of their holdings.

3. Placing the Order

The next step after the opening of a Demat Account is the placing of an order by the investor. The investor can place the order to the broker either personally or through email, phone, etc. The investor must make sure that the order placed clearly specifies the range or price at which the securities can be sold or bought. For example, an order placed by Kashish is, “Buy 200 equity shares of Nestle for no more than ₹200 per share.”

4. Match the Share and Best Price

The broker after receiving an order from the investor will have to then go online and connect to the main stock exchange to match the share and best price available.

5. Executing Order

When the shares can be bought or sold at the price mentioned by the investor, it will be communicated to the broker terminal, and then the order will be executed electronically. Once the order has been executed, the broker will issue a trade confirmation slip to the investors.

6. Issue of Contract Note

Once the trade has been executed within 24 hours, the broker will issue a contract note. A contract note consists of the details of the number of shares bought or sold, the date, time of the deal, price of securities, and brokerage charges. A contract note is an essential legal document. It helps in settling disputes claims between the investors and the brokers. A contract note also consists of a printed unique order code number assigned to each transaction by the Stock Exchange.

7. Delivery of Share and making Payment

In the next step, the investor has to deliver the shares sold or has to pay cash for the shares bought. The investor has to do so immediately after receiving the contract note or before the day when the broker shall make delivery of shares to the exchange or make payment. This is known as Pay in Day.

8. Settlement Cycle

The payment of securities in cash or delivery of securities is done on Pay in Day, which is before T+2 Day. It is because the settlement cycle is T+2 days on w.e.f April 2003 rolling settlement basis. For example, if the transaction took place on Tuesday, then the payment must be done before Thursday, i.e., T+2 days (Transaction plus two more days).

9. Delivery of Shares or Making Payment

On the T+2 Day, the Stock Exchange will then deliver the share or make payment to the other broker. This is known as Pay out Day. Once the shares have been delivered of payment has been made, the broker has to make payment to the investor within 24 hours of the pay out day, as he/she has already received payment from the exchange.

10. Delivery of Shares in Demat Form

The last step of the trading procedure is making delivery or shares in Demat form by the broker directly to the Demat Account of the investor. The investor is obligated to give details of his Demat Account and instruct his Depository Participant (DP) for taking delivery of securities directly in his beneficial owner account.

Please Login to comment...