Calls in Advance: Accounting Entries on Issue of Shares

Last Updated :

05 Apr, 2023

A unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,000 and is divided into 10,000 units of ₹100 each. Each unit of ₹100 will be called a share. To easily identify the shares, it is essential to give them numbers. The share of a company is moveable in nature and can be moved through the process stated by the Articles of Association of the Company.

According to Indian Companies Act, 2013, “Shares means shares in share capital of the company and includes stock except where the distinction between stock and share is expressed or implied.”

Calls in Advance:

Calls in Advance is just opposite to Calls in Arrear. It is a situation when the shareholders of a company pay the amount not yet called upon his shares. In other words, Calls in Advance is the amount of future calls which is received by the company in advance. Section 50 of the Companies Act, 2013 says that the company can accept the amount of Calls in Advance only when it is authorised by its Articles of Association.

Journal Entries

1. When the company received Calls in Advance money:

Note:

The amount of Calls in Advance is shown on the Equity & Liabilities side of the Balance Sheet under “Current Liabilities” as “Calls in Advance A/c”.

2. When the call is made by the directors:

A.

B.

Illustration:

Kanika Ltd. has an authorised capital of ₹10,00,000. The company invited applications for 8,000 shares @ ₹10 each payable as: ₹3 on Application, ₹3 on Allotment, ₹2 on First Call, and ₹2 on the Second & Final Call. The shares were fully subscribed and the amount was received. Vishal, the holder of 500 shares paid the whole amount of the first and second call with allotment. Madhur, the holder of 200 shares paid the amount of the second call with the first call. Pass necessary Journal Entries in the books of Kanika Ltd.

Solution:

Interest on Calls in Advance:

The amount received by a company as Calls in Advance is its debt; i.e., the company is liable to pay this amount from the date of receipt till the date when the call is due for payment. Generally, the rate of interest on Calls in Advance is specified by the Article of Association of the Company. However, if the rate is not specified in the Articles, then Table F of Schedule I of the Companies Act, 2013 will be applicable, leaving the matter in the hands of the directors of the company subject to a maximum rate of 12% p.a. Besides, the interest on Calls in Advance is charged against the profits of the company. It is mandatory for a company to pay Interest on Calls in Advance even if there is no profit. Besides, the dividend on the shares for which calls in advance have been received is not payable as it is not a part of Share Capital.

Journal Entries:

1. On making due the Interest on Calls in Advance:

2. On receipt of Interest on Calls in Advance:

3. On transfer of Interest on Calls in Advance to Profit & Loss A/c at the end of accounting period:

Note: If the rate of interest on Calls in Advance is not mentioned in a question, then 12% p.a. will be taken.

Illustration:

Shreya Ltd. issued 5,000 shares of ₹10 each payable as follows:

₹5 on Application (1st February 2022)

₹2 on Allotment (1st April 2022)

₹3 on First & Final Call (1st June 2022)

Khushboo, holder of 600 shares paid the full amount on application, and Nisha to whom 500 shares were allotted paid the First & Final Call money along with allotment. Interest @ 12% was paid on 1st June 2022. Pass necessary Journal Entries in the books of Shreya Ltd.

Solution:

Calculation of Interest:

Khushboo’s 600 shares @ ₹3; i.e., 1,800 for 2 months

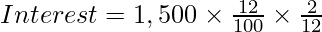

= 36

Nisha’s 500 shares @ ₹3; i.e., 1,500 for 2 months

= 30

Total Interest = 66

Note: Interest on Calls in Advance is always calculated from the date of allotment in case any advance amount is received on the application.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...