New profit sharing means the ratio in which all the partners including the new partner will share future profit and loss of the business. When a new partner is admitted into the business, he becomes entitled to share in future profits and losses of the business. The new partner admitted will have to acquire his/her share in the business from the share of the old partners. Therefore, it is important to determine the new profit-sharing ratio of all the partners, including the new partner. The new profit sharing ratio is the share of each partner, including the new partner, in future gains and losses of the business.

A new or incoming partner can acquire his share from the old partners in the following manner:

1. In their old profit-sharing ratio

2. In a particular or surrendered ratio

3. In a particular fraction by some partners

4. His/her share completely from one old partner

5. Old partners share in a fixed proportion

Computation of New profit sharing ratio in different cases:

Case 1: When only the new partner’s ratio/share is given:

Under this method, the new partner acquires his share of future profit and losses in the firm from the old partners in their old profit-sharing ratio. Old partners continue to share the balance of profits in their old profit-sharing ratio. New profit sharing is determined by deducting the new partner’s share from 1 and dividing the remaining share in the old profit sharing ratio among the old partners. The profit sharing ratio will remain the same among the old partners under this situation.

Steps to calculate new profit sharing ratio:

Step 1: Let the total share be 1.

Step 2: Calculate the remaining share of the old partner by deducting the new partner’s share from the total share.

Step 3: Distribute the calculated remaining share among the old partners in their old profit-sharing ratio.

Illustration:

M and N are partners sharing profits and losses in the ratio of 4:3. R is admitted into for  share in the profits and losses of the firm. Calculate the new profit-sharing ratio.

share in the profits and losses of the firm. Calculate the new profit-sharing ratio.

Solution:

Let the total profit be 1

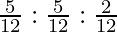

Share of M and N =

=  ( this will be shared among M and N in a 4:3 ratio)

( this will be shared among M and N in a 4:3 ratio)

M’s share =

=

N’s share =

=

M and N share =

=

R’s share =

New profit sharing ratio of M, N, and R =

= 4:3:7

Case 2: When old partners distribute the balance share in a fixed proportion:

Under this method, the new partner acquires his share of future profit and loss of the firm from the old partners in their old profit-sharing ratio. Old partners share the balance of profits in a fixed proportion. New profit sharing is determined by deducting the new partner’s share from 1 and dividing the remaining share in the fixed proportion among the old partners. The new profit-sharing ratio of the old partners is in a fixed proportion.

Steps to calculate new profit sharing ratio:

Step 1: Let the total profit be 1.

Step 2: Calculate the remaining share of the old partner by deducting the new partner’s share from the total share.

Step 3: Distribute the calculated remaining share among the old partners in the fixed proportion.

Illustration:

S and T are partners sharing profit and losses in a ratio of 7:3. D is admitted for a  share in the profits and losses of the firm. The new profit-sharing ratio of S and T will be equal. Calculate the new profit-sharing ratio.

share in the profits and losses of the firm. The new profit-sharing ratio of S and T will be equal. Calculate the new profit-sharing ratio.

Solution:

Let the total profit be 1

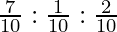

Share of S and T =

=  ( this will be shared among S and T in a 4:3 ratio)

( this will be shared among S and T in a 4:3 ratio)

S’s share =

=

T’s share =

=

S and T share =

= 5:5

D’s share =

New profit sharing ratio of S, T, and D =

= 5:5:2

Case 3: When the new partners’ share is contributed by old partners in a fixed ratio:

Under this method, the new partner acquires his share of profits in the future, a part of the share from one partner and another part of the share from another partner. The old partner’s new share in the reconstituted firm is determined by deducting the share contributed by them from the old profit-sharing ratio.

Steps to calculate new profit sharing ratio:

Step 1: Determine the new partner’s share by adding the shares contributed by the old partners.

Step 2: Calculate the share of old partners by deducting the share contributed by them to the new partner from their old profit sharing ratio.

Illustration:

E and F are partners sharing profit and losses in the ratio of 2:1. P is admitted as a new partner. P acquires  share from E and

share from E and  share from F. Calculate the new profit sharing ratio.

share from F. Calculate the new profit sharing ratio.

Solution:

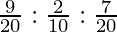

Sacrifice by E =

=

Sacrifice by F =

=

The new share of E and F will be:

E’s New Share =

=  (To make the denominator equals to 36)

(To make the denominator equals to 36)

=

F’s New share =

=  (To make the denominator equals to 36)

(To make the denominator equals to 36)

=

P’s share = Share Sacrificed by E + Share Sacrificed by F

=

=

=

New profit sharing ratio of E, F, and P = 16:9:11

Case 4: When a new partner purchases his share entirely from one partner:

Under this method, the share of a new partner is the share contributed by one partner. One of the old partners contributes entirely the share of the new partner in future profits. The new share of that old partner who contributed his share to the new partner is determined by deducting the share contributed from the old profit sharing ratio.

Steps to calculate new profit sharing ratio:

Step 1: Deduct the share contributed to the new partner from the old partner’s share of profit and loss to calculate the new share of the old partner.

Step 2: Share of the new partner in future profits and losses in the firm is entirely the share contributed by the one old partner.

Illustration:

R and S are partners in the firm sharing profit and losses in the ratio of 7:3. X is admitted as the new partner. X is admitted for  share, which he acquires completely from S. Calculate the new profit sharing ratio.

share, which he acquires completely from S. Calculate the new profit sharing ratio.

Solution:

New share of S =

=

New profit sharing ratio of R, S, and X =

= 7:1:2

Case 5: When old partners give a part of their share to a new partner:

Under this method, the share of the new partner in future profit and loss of the firm is the sum of surrendered shares by the old partners. The surrendered share by the old partners in favour of the new partner is deducted from the old profit-sharing ratio to determine the new share of the old partners. In the new profit sharing ratio of the firm the share of the new partner is a part of the share of the old partners surrendered.

Steps to calculate new profit sharing ratio:

Step 1: Calculate the share surrendered by the old partner in favour of the new partner by multiplying the share contributed with the old share in profit.

Step 2: Calculate the new share of old partners by deducting the share surrendered from the old profit sharing ratio.

Step 3: Add the shares surrendered by the old partners in favour of the new partner to calculate the new partner profit sharing ratio.

Illustration:

G and H are partners in the firm sharing profit and losses in a ratio of 3:2. J is admitted as the new partner. G surrenders  of his share and H surrenders

of his share and H surrenders  of his share for the new partner, J. Calculate the new profit sharing ratio.

of his share for the new partner, J. Calculate the new profit sharing ratio.

Solution:

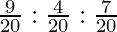

G’s share =

G surrender in favor of J =

=

So, G’s new share =

=

H’s share =

H’s surrender in favor of J =

=

So, H’s new share =

=

J acquires =

=

New profit sharing ratio of G, H, and J =

=

= 9:4:7

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...