Sales Tax, Value Added Tax, and Goods and Services Tax – Comparing Quantities | Class 8 Maths

Last Updated :

11 Feb, 2021

Tax is a mandatory fee levied by the government to collect revenue for public works providing the best facilities and infrastructure.

The first known Tax system was in Ancient Egypt around 3000–2800 BC, in First Dynasty of Egypt. The first form of taxation was corvée and tithe. In India, The Tax was first introduced in 1860 by Sir James Wilson.

The government collects tax from its citizens to provide facilities like Electricity, Roads, Railways, etc. It is the most known financial term and also a Primary Source of Income for the government for expenditure on different Economic Infrastructures and Projects.

Effective Tax Rate Formula:

- For Individual = (Total Tax Expenses)/(Taxable Income)

- For Corporation = (Total Tax Expenses)/(Earnings before Taxes)

Citizens pay Tax in many forms, for instance, whenever we go to some restaurant or for some shopping. At the time of payment, when the bill is generated. It generally has this form,

Apart from the Bill Amount, there is another amount added ST (Sales Tax), VAT (Value Added Tax), GST (Goods and Service Tax).

Sales Tax, Value Added Tax, and GST

Sales Tax:

Sales tax (ST) is charged on the sale of an item. Businessmen collect it from the customer and then give it to the government. This is why it is always on the selling price of an item and then this value is added to the bill.

Value Added Tax:

It is a type of tax whose price is already included in the price of the product. Nowadays almost all the products we buy have some percentage of VAT added to them.

GST – Goods and Services Tax:

The government of India introduced GST in 2017, it stands for Goods and Services Tax which is levied on the supply of goods or services or both.

Now let’s look at some examples to explain the applicability of these taxes.

Examples:

Question 1: The cost of a pair of shoes at a shop was Rs. 450. The sales tax was charged to be 5%. Find the total bill amount.

Solution:

It is given that 5% tax is charged on the cost of shoes.

Now, the Total bill amount = Sales Tax + Cost

we know, Cost = 450, but we need to calculate Sales Tax.

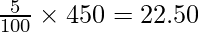

Sales Tax = 5% of 450 =

So, Total bill amount = Sales Tax + Cost

= 22.50 + 450

= 472.50

Question 2: Aman bought a Phone for Rs. 33000 which includes a tax of 10%. Find the price of the jeans before VAT was added.

Solution:

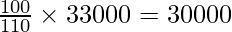

VAT (Value Added Tax) is included in the price.

To understand it, a 10% VAT means that if the cost of the item is 100, then with VAT it’s cost will be 110.

i.e; when price included with VAT is 110, actual price is 100.

Since in our case, price included with VAT is 33000. The actual price should be,

Actual Price =

Question 3: Suppose you bought an article for Rs. 784 which included a GST of 12%. What do you think was the price before GST was added?

Solution:

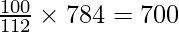

Let’s say original price of the article was Rs. 100.

So, after 12% GST it became 112.

i.e if the price included with GST is 112, actual price is 100.

So in our, Price included with GST is 784.

Actual Price =

Thus, the actual price of the article is 700.

Like Article

Suggest improvement

Share your thoughts in the comments

Please Login to comment...